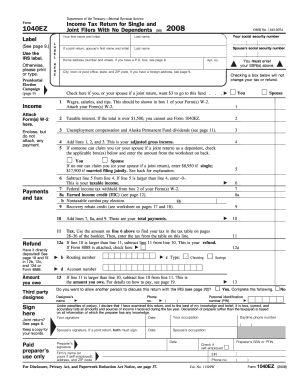

You claim adjustments to income for IRA contributions and student loan interest.If you elect direct deposit for getting your refund, then enter and check your bank account information on lines 13b, Routing Number, 13c, type of account, and 13d Account Number (See instructions under Direct Deposit to view a sample check).Check the box, Full-year coverage, on line 11 if you have qualifying health care coverage for all of 2015.Don’t forget to enter your Tax amount on line 10.You are not claiming any tax credits other than the Earned Income Credit.You do not have any adjustments to income.You are claiming the standard deduction only (Can't itemize using Schedule A).You and your spouse are under 65 years old at the end of 2015.Your filing status is single or married filing jointly.Your taxable income is less than $100,000.In addition to information about Federal income tax brackets, provides a total of 775 Federal income tax forms, as well as many federal income tax forms.Which Form to choose: 1040EZ? 1040A? or 1040? Other Federal Individual Income Tax Forms: We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government. This form is for income earned in tax year 2022, with tax returns due in April 2023. We last updated Federal Form 1040-EZ in December 2022 from the Federal Internal Revenue Service. FREE for simple returns, with discounts available for users! File your Federal and Federal tax returns online with TurboTax in minutes.

EFiling is easier, faster, and safer than filling out paper tax forms.

0 kommentar(er)

0 kommentar(er)